Rejoignez Desjoyaux, le 1er réseau exclusif mondial de construction de piscine enterrée. Concept Desjoyaux ! Blank Franchise Tax Returns are not available. Exempt domestic corporations do not pay a tax but must file an Annual Report. Assumed Par Value Capital Method.

The minimum tax is $ 175. All corporations using either method will have a maximum tax of $20000. When a company falls behind on paying franchise tax and good standing is lost, the shield goes down, exposing the company owner’s personal assets to creditors of the company.

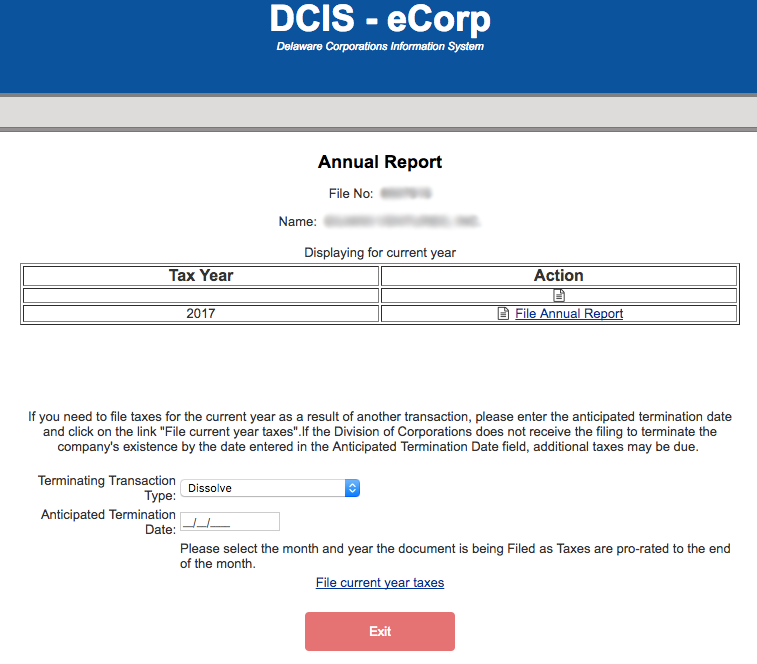

This is where keeping. For an Annual Report or Amended Annual Report for non-exempt domestic corporations the filing fee is $50. Corporate Annual Report and Franchise Tax Payments.

Taxes and Annual Reports are. I won’t get into a nitty-gritty, but suffice it to say that you can use one that minimizes your tax liability. Make Text Size Smaller Reset Text Size Make Text Size.

Cependant, si cette catégorie de cookies - qui ne stocke aucune donnée personnelle - est bloquée, certaines parties du site ne pourront pas. How to Pay Franchise Tax in Delaware.

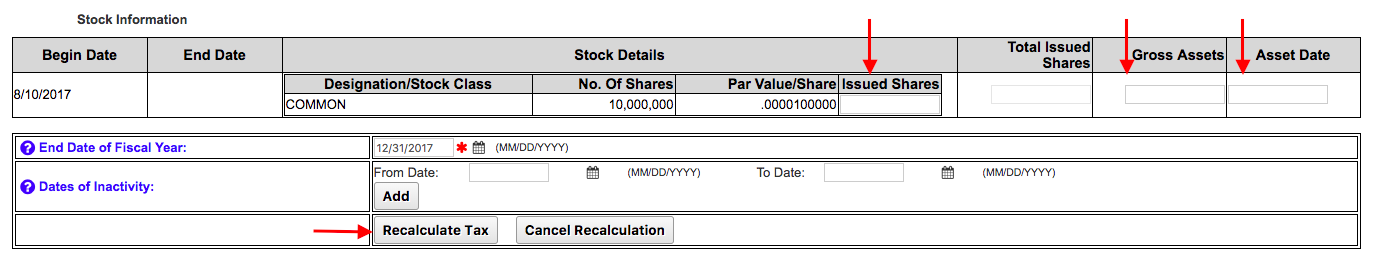

Click here for everything you need to know. Franchise taxes are generally due in arrears for the prior calendar. Delaware requires these reports to be filed electronically. For corporations using the Authorized Shares Metho the minimum franchise tax is $1and the maximum franchise tax is $20000.

Domestic corporations must file by March or face a $2penalty, and a 1. As registered agent we are required to notify you that the annual franchise tax is due March 1. If the annual franchise tax report and the franchise tax due are not filed or paid by the corporation as required by this chapter, the Secretary of State shall ascertain and fix the amount of the franchise tax as determined in the manner prescribed by § 503(a) of this title and the amount so fixed by the Secretary of State shall stand as the basis of taxation under the provisions of this. A penalty fee of $2will be added if the annual report is not filed by the due date.

For each additional 10shares, add $to the tax total, with a maximum franchise tax of $18000. Yes, you read that right! But you can often save a lot of money using the.

When you pay the franchise tax, you’re actually paying for the previous year—the franchise tax paid in any given year is for the preceding calendar year. Most startups incorporate in Delaware. Every corporate is required to pay a Franchise Tax and file an Annual Report.

There is a minimum tax and fee of $225. Estimated tax installments are required of taxpayers with an annual tax liability in excess of $1000. Typically, this corporation is better off to use the second calculation option. DE Corps-domestic: minimum $2depending on authorized shares.

Most people tell us that they associate the word “ franchise ” with a specific business model. While that may be true, that is not what the term “ Franchise Tax.

Calculating franchise taxes is one of them, or in particular, their default method for calculating franchise taxes and how they present this bill to corporations. Who has to file and pay? Failure to pay the needed annual taxes will result in a penalty of $200.

Depending on industry, you may have more obligations. If your entity has 0authorized shares or less, the Franchise Tax is $75. So, you started a new business and are planning to make it big one day.

Using the standard approach with attorneys for early-stage startups (an approach we agree with), you decide to authorize a large number of shares at the formation of your business, in this. Alliance Comtal Taxi : Pour tous vos Déplacements Pros et Touristiques.

Aucun commentaire:

Enregistrer un commentaire

Remarque : Seul un membre de ce blog est autorisé à enregistrer un commentaire.