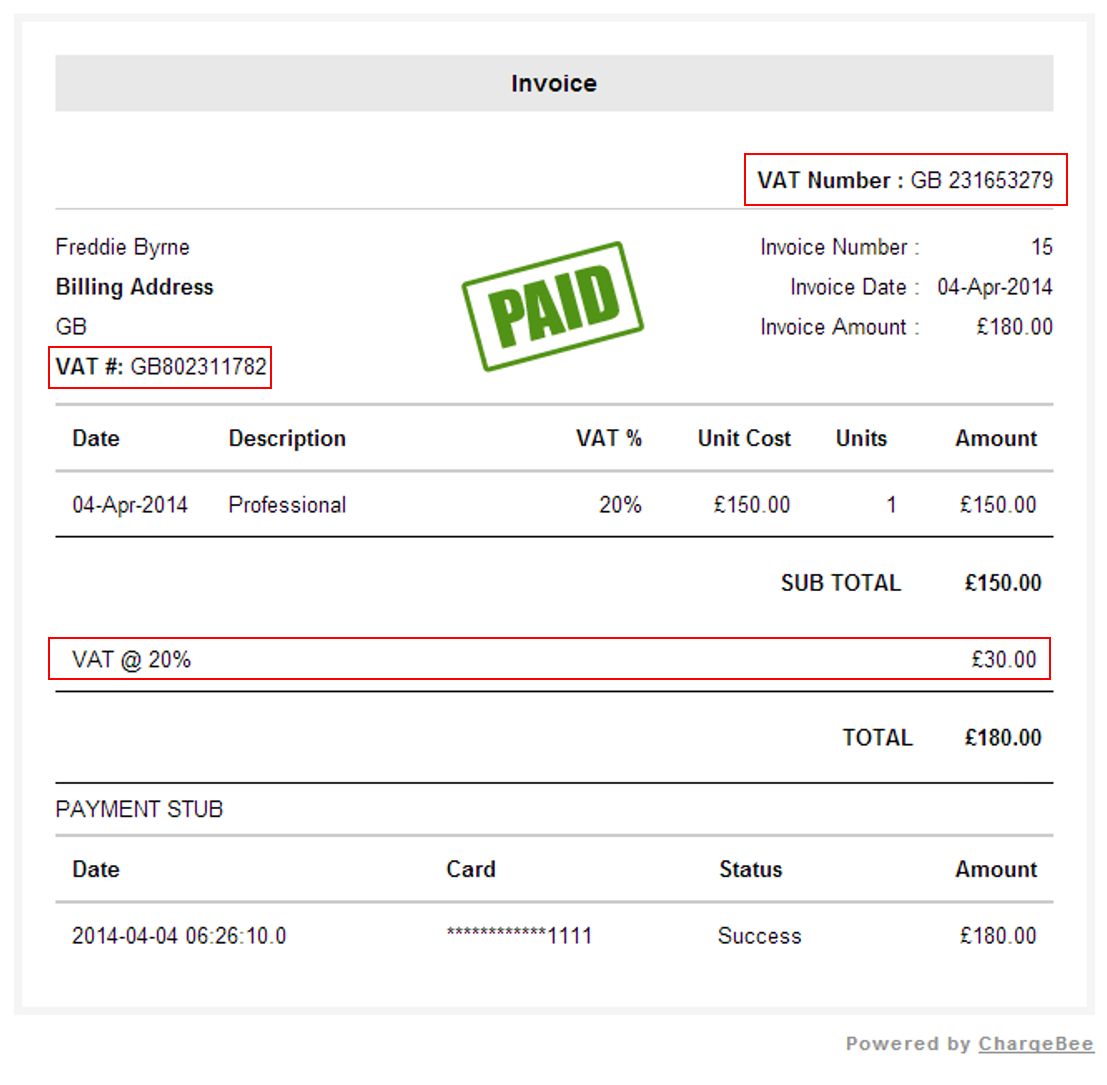

VIES VAT number validation. You can verify the validity of a VAT number issued by any Member State by selecting that Member State from the drop-down menu provide and entering the number to be validated. Sometimes also known as a VAT registration number, this is the unique number that identifies a taxable person (business) or non-taxable legal entity that is registered for VAT.

Check whether a VAT number is valid. Who needs a VAT number? Most businesses (and other persons carrying out an economic activity) need a VAT number (see Article 2VAT Directive for full details).

In particular, business is obliged to register. Qu’est-ce qu’un numéro d’identification TVA? These changes are not always reflected immediately in the national databases and consequently in VIES. Each EU member country has a slightly different format for their VAT number system, featuring a variation of numbers and letters.

It confirms that the number is currently allocated and can provide the name or other identifying details of the entity to whom the identifier has been allocated. However, many national governments will not give out VAT identification numbers due to data protection laws. VAT -Search has more than 6clients including By using VAT -Search.

Basic principles of the EU -wide rules. Looking For Uk Vat Number? We Have Almost Everything On eBay. Find Great Deals Now!

A VAT number is a registered tax identification number in tax systems that use Value-Added Tax ( VAT ). When you register for VAT in a single country, you receive a VAT number for their tax system. At Vatcheck you can check the VAT number of all European companies.

Validate here the VAT number of your client at each sale transaction to a foreign enterprise, this is important to be sure that you can exempt the sale from VAT. If you sell goods to a business and these goods are sent to another EU country, you do not charge VAT if the customer has a valid EU VAT number. Save the VAT numbers in an Excel worksheet and send it to us. You can also check VAT numbers by company name so you can find the vat registration number.

We cross check this with the vast companies database on Datalog. We currently have VAT details of over 1. We also have VAT registration history data. Though VAT numbers usually consist of numeric digits only, some western countries have VAT numbers that also contain letters. Also, fair warning, foreign countries outside of the EU may have a VAT number starting with “EU.

Allow valid EU businesses the choice of paying tax at your store This extension provides your checkout with a field to collect and validate a customer’s EU VAT number, if they have one. Upon entering a valid VAT number, the business will not be charged VAT at your store. A European company VAT registration number is like a social security number but for businesses.

In Europe, companies have different formats depending on which country they reside in but it usually follows this principle: Country code, the organization number and sometimes plus " " or another appendix combination at the end like for Cyprus VAT -numbers which ends with "L". Are concerned all European companies subject to VAT in a Member State which, as part of its trade exchanges with a company located in another Member State, has a tax identification number called intra-Community VAT number.

Intra-Community VAT number used to charge VAT in Europe but also allows the exemption from VAT when invoicing. In this case, must appear on the invoice your intra-Community VAT number and that of your client. Remember, it is essential that your business, as well as the. The VAT number is a unique code which a business is given when it registers itself with a tax authority in the European Union.

As the supplier you must state your customer’s validated VAT number on the invoice. This means that you should re-validate VAT numbers whenever a scheduled charge becomes due (for example on a subscription model). A non EU business may trade in electronic services in the EU using a VAT number prefixed with EU.

If a business based outside the EU supplies electronically supplied services to end customers in the EU they would normally, subject to the local conditions, be expected to register for VAT in the country where the services are consumed.

Aucun commentaire:

Enregistrer un commentaire

Remarque : Seul un membre de ce blog est autorisé à enregistrer un commentaire.